TL;DR

- Real estate fraud is now an AI-enhanced ecosystem problem, not a single-point failure.

- Deepfakes, synthetic identities, and document forgeries are driving record losses in 2025–2026.

- The real estate ecosystem is fragmented, giving criminals room to slip through.

- Agents and brokers now carry a new duty of care to protect buyers and investors.

- Simple steps like verification calls, secure portals, and ID validation can prevent catastrophic losses.

If you’ve been in real estate long enough, you’ve probably felt it: transactions that used to run on trust now feel more fragile than ever. Deals fall apart because an email was spoofed. A seller turns out to be a deepfake on Zoom. A buyer’s down payment vanishes into a mule account.

And the heartbreaking part?

Most of these losses could be prevented with just a few deliberate steps — if we understand where the risks really hide.

As someone who has tracked the rapid escalation of synthetic identities and AI-driven impersonation since COVID, the data is unmistakable: real estate has become one of the highest-risk sectors for digital fraud. Transactions routinely involve six- and seven-figure values, span 6–12 different intermediaries, and depend on fragmented verification practices. Evidence from FinCEN, the FBI, and multiple title-insurance analyses shows that synthetic identities, forged documents, and deepfake social engineering now exploit the weakest link in this chain. The infrastructure simply wasn’t engineered for adversaries using generative AI — making real estate a prime battleground for modern cyber-enabled crime.

— Dr. Joseph Mwangoka, Founder & Lead Consultant, BranchedFlow Inc.

Part 1: Why Real Estate Deepfake Scams Are Surging

Real estate deepfake scams are increasing because criminals now use AI to forge identities, fabricate documents, and impersonate professionals at scale. The industry’s fragmented workflow — spanning banks, agents, title firms, lawyers, and consumers — creates multiple weak points that fraudsters can exploit with a single breach.

The Real Shift: Fraud Has Industrialized

Real estate fraud used to require physical forgery, insider access, or months of preparation. But generative AI has removed those barriers. Criminals can now mass-produce:

- fake IDs

- synthetic borrower profiles

- doctored pay stubs

- deepfake video seller verifications

- cloned voice authorizations

- fake listings and fake agents

What used to take a criminal ring 6–12 months can now be done in hours.

Three accelerators behind the surge

✔️ 1. AI makes fraud convincing

Even trained professionals struggle to distinguish authentic vs. fake documents or IDs when deepfake artifacts are subtle.

✔️ 2. The ecosystem is fragmented

No single party has full visibility into the transaction — meaning fraudsters exploit the gaps between:

- real estate agents

- mortgage brokers

- lenders

- appraisers

- title companies

- lawyers

- consumers

- escrow offices

- banks

✔️ 3. High-value, time-sensitive transactions = perfect targets

Criminals love urgency.

Real estate buyers often wire hundreds of thousands of dollars under pressure and based on trust.

This combination has made real estate one of the most profitable fraud verticals in North America — and one of the least defended.

How Today’s Real Estate Cyber-Fraud Ecosystem Actually Works

Real estate fraud works because attackers exploit communication gaps and trust relationships between multiple independent stakeholders. They enter the ecosystem at weak points — often through email compromise, impersonation, synthetic documents, or fake identity onboarding — and move laterally until they can redirect funds or transfer ownership.

Overview of the Ecosystem

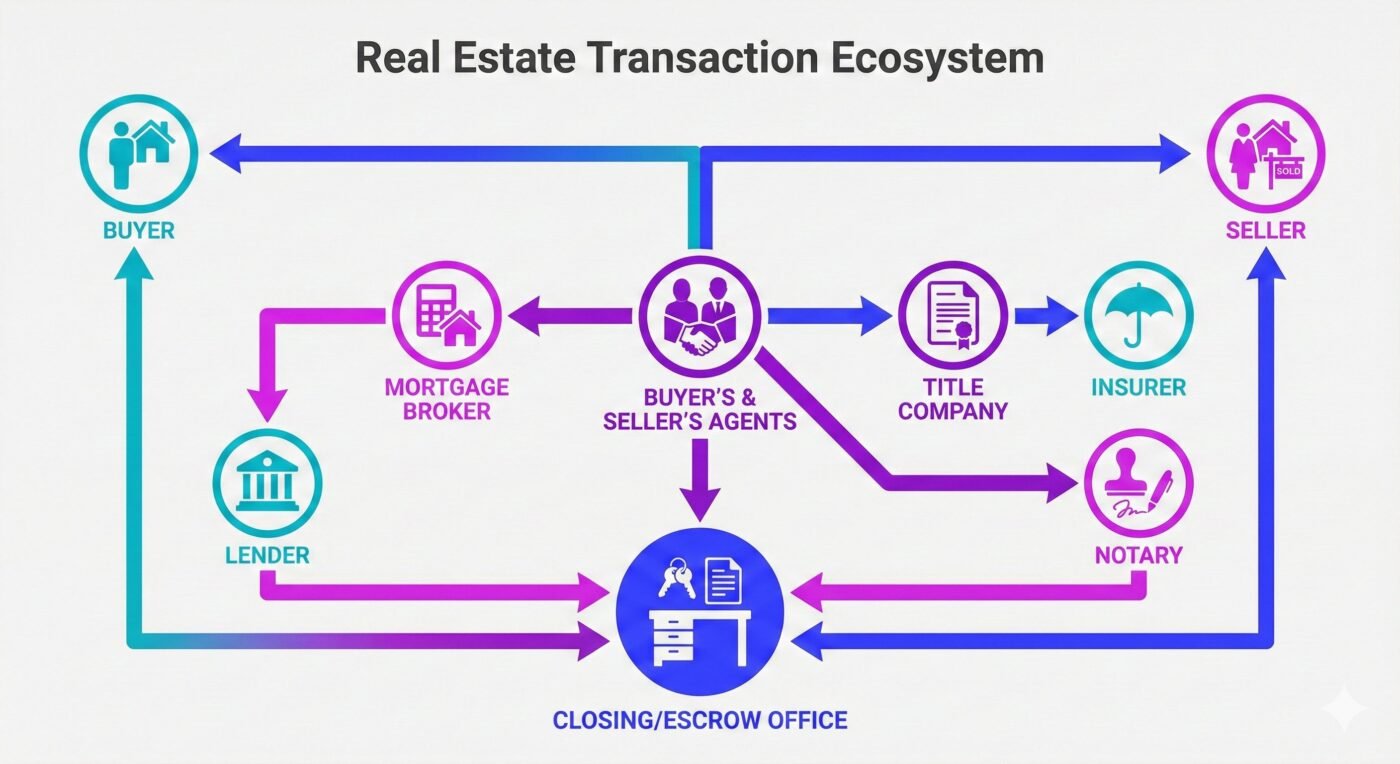

The above diagram shows the different components of the ecosystems and their functions:

- Banks verify borrower identity, fund loans, and process wires.

- Agents & brokers communicate heavily through email — often unsecured.

- Title companies handle escrow, closing funds, and ownership verification.

- Lawyers/notaries validate documents and execute transfers.

- Consumers rely entirely on the guidance of professionals.

- Fraudsters infiltrate any of these nodes to hijack the whole transaction.

This is why we say:

Real estate doesn’t have a fraud problem. It has a coordination problem criminals exploit.

Some interesting statistics

Some of the vulnerabilities of the ecosystem:

- Deepfake Zoom calls used to “verify” a fake seller

- Synthetic borrowers qualifying for mortgages they never plan to repay

- Homes sold without the owner’s knowledge

- $200,000–$500,000 in closing funds wired to mule accounts

- Fake property listings collecting deposits from multiple victims

- Agents’ emails hacked and used to send fraudulent instructions

In most cases, the fraudster never sets foot in the country.

Mini Case Example: (What happened?)

A Toronto listing agent thought she was dealing with an overseas seller. The seller joined the call via video, showed ID, and signed the paperwork. Everything looked clean.

But the “seller” was a deepfake, the ID was AI-generated, and the entire property was sold out from under the real owner, who discovered it only when condo fees stopped withdrawing.

The title insurer spent months unwinding the fraud.

Key lesson:

Real estate professionals are now identity security gatekeepers — whether they realize it or not.

The Fragmented Ecosystem: Why Everyone Is at Risk

When you break down the modern real estate transaction, you see a chain of trust involving 15–30 people, none of whom have perfect visibility.

Each of these nodes is a fraud entry point:

- Listing agent

- Buyer’s agent

- Lawyer / conveyancer

- Mortgage broker

- Lender

- Underwriter

- Appraiser

- Title officer

- Notary

- Property manager

- Bank wire desk

- Insurance provider

- MLS / portal systems

- Consumers

- Email systems connecting all of them

Fraudsters only need to compromise one.

Fraud is ecosystem-driven, not department-driven

A mortgage scam may begin with:

- A forged paystub (document fraud)

- Then flow through underwriting (automation blind spots)

- Then require a complicit agent (insider collusion)

- And finally land at a title company (weak ID verification)

The industry treats fraud as an event.

Criminals treat it as a pipeline.

“Duty of Care” — The New Reality for Agents, Brokers & Intermediaries

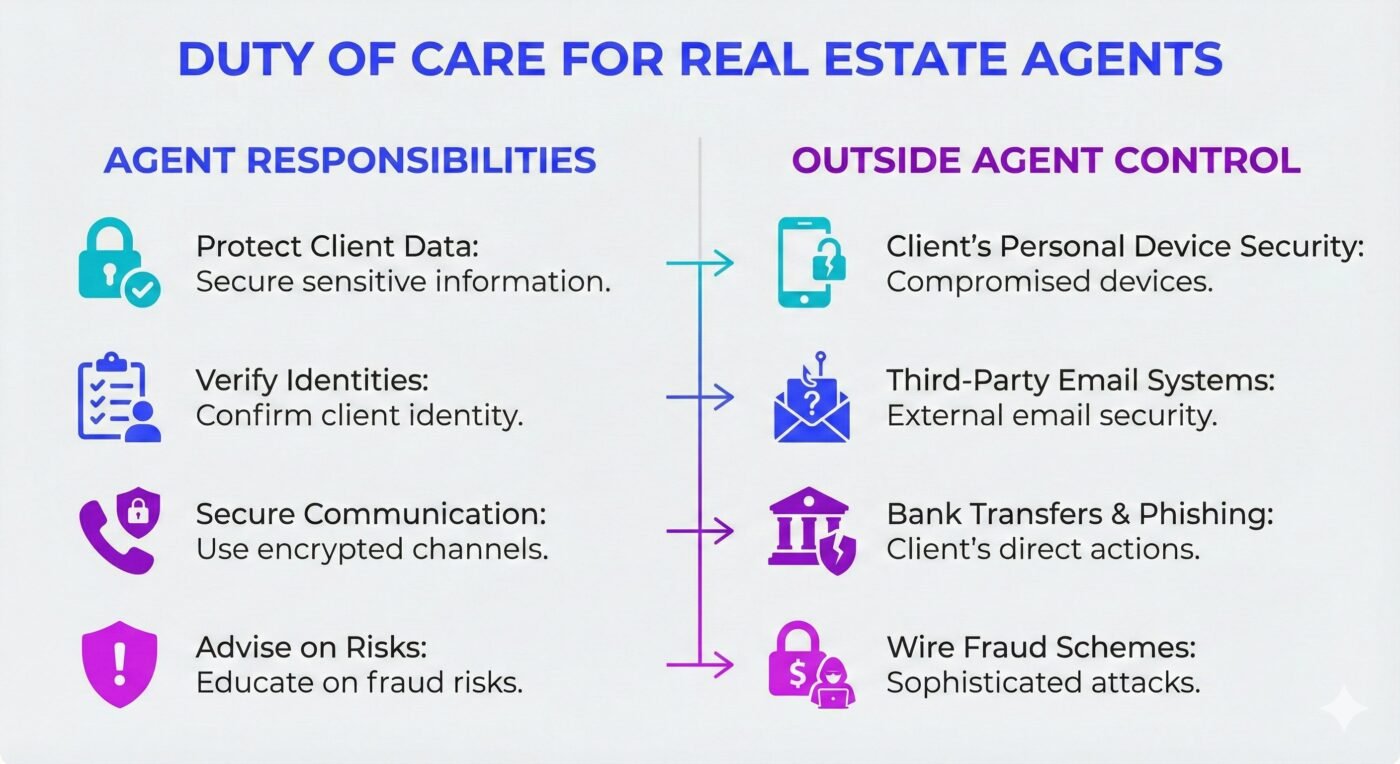

Because consumers rely on agents and brokers for guidance, the industry now faces an elevated duty of care: protecting clients not just from bad deals, but from sophisticated cyber-fraud. This means verifying identities, securing communication channels, and educating clients about wire fraud and impersonation risks.

Why duty of care is increasing in Canada

Regulators are tightening expectations around:

- identity verification

- cybersecurity hygiene

- record-keeping

- client communication safety

- secure fund movement

Agents and brokerages who ignore these responsibilities not only put clients at risk — they increase their own litigation and E&O exposure.

This isn’t optional anymore.

It’s the new price of doing business in a digital real estate market.

Quick-Scan Table: Where Fraud Enters the Real Estate Pipeline

| Stakeholder | Weak Point | Fraud Type | Impact |

|---|---|---|---|

| Agent/Broker | Email, ID verification | BEC, impersonation | Stolen deposits |

| Title Company | Wire instructions | Escrow redirection | Loss of closing funds |

| Lender | Automated underwriting | Synthetic identities | Fraudulent mortgages |

| Notary/Lawyer | Remote signatures | Deepfake seller | Stolen property |

| Consumer | Pressure + trust | Fake listings, fake agents | Lost savings |

PART 2 — BANKS, SYNTHETIC IDENTITIES & AI-DEEPFAKE MORTGAGE FRAUD

How Banks Became Ground Zero for AI-Driven Mortgage Fraud

Banks are being overwhelmed by synthetic identities, AI-generated documents, and deepfake borrower interactions that slip through automated onboarding and underwriting systems. Fraudsters exploit the speed of digital lending — leaving lenders, insurers, and sometimes taxpayers to bear the losses.

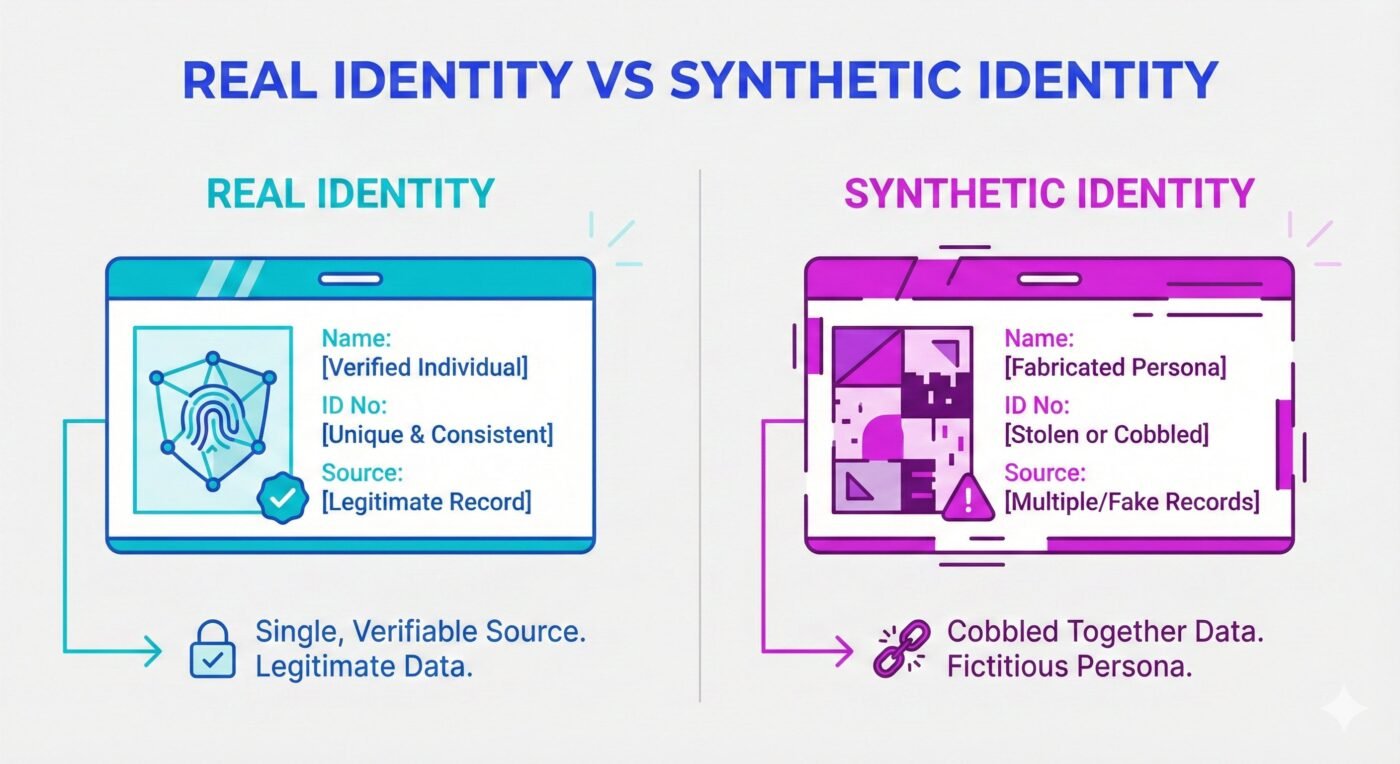

Why Synthetic Identity Fraud Is Exploding in Mortgage Lending

Synthetic identity fraud is the fastest-growing financial crime in North America. It’s not identity theft — it’s identity manufacturing.

Criminals build a “borrower” from:

- a real Social Insurance Number (SIN)

- a fake name

- a new credit profile

- AI-polished supporting documents

- staged digital footprints

Banks’ automated systems see:

- a credit score

- a clean history

- valid-looking ID

- verified pay stubs

- “consistent” digital behaviour

But all of it is fiction.

“Synthetic identities succeed because they’re engineered to be low-risk. Fraudsters design them to pass exactly the checks banks rely on.”

The Mortgage Deepfake Problem: AI is Now a Co-Conspirator

Fraudsters now use AI to produce:

- deepfake selfies for KYC checks

- voice clones for telephone verifications

- fake employer verifications using chatbot-generated HR reps

- doctored PDFs for pay stubs, settlements, tax returns

- fake bank statements with AI-generated transaction histories

And because banks process millions of documents per day, automated workflows can’t detect all anomalies.

Common AI-forged documents now seen by lenders:

- Pay stubs with perfectly aligned numbers

- Bank statements with synthetic metadata

- Government IDs recreated in high resolution

- Court documents (e.g., divorce decrees) generated by LLMs

What used to take professional forgery labs now takes 20 minutes and a laptop.

Inside a Real $55M Mortgage Fraud Case (Simplified Overview)

This is the kind of fraud case becoming disturbingly common.

The structure typically looks like this:

- Creation of synthetic borrowers

Real SIN + fake name; fake employment documents; digital history built with microloans; online application. - Automated systems approve

Documentation appears consistent, so rules-based underwriting passes it. - Insider override

A complicit loan officer approves files despite red flags. - Funding + extraction

Fraudsters pull cash out, refinance, or let loans default. - Lender + insurer losses

Mortgage insurers, title insurers, and government insurers absorb the fallout.

Why Banks and Lenders Miss These Frauds

- Digital Onboarding is Fast — Too Fast

Banks pride themselves on approving loans in hours. Fraudsters rely on that speed. - Automation Trusts the Documents Too Much

Underwriting validates format, not authenticity. - No One Sees the Whole Picture

Lenders see the loan file. Agents see the buyer. Title sees the closing. Banks see the wire. Nobody connects the dots. - Insider Collusion Is a Hidden Threat

One compromised loan officer can greenlight 20–50 fraudulent files. - Volume Overwhelms Human Review

Lenders process tens of thousands of files monthly. Fraudsters hide in the flow.

PART 3 — INSURANCE RISKS, TITLE FRAUD & THE DEEPFAKE SELLER EPIDEMIC

How Title & Insurance Companies Became the Last Line of Defense — and the New Prime Targets

Title companies and real estate insurers now face unprecedented exposure as criminals use forged deeds, synthetic identities, and deepfake video calls to impersonate property owners. These schemes bypass traditional checks and push massive financial and legal risk onto insurers, who often become the only entity financially covering the damage after the fraud is discovered.

Why Title Fraud Is Skyrocketing

Title fraud is no longer a fringe crime — it’s become one of the fastest-growing and most traumatic forms of real estate fraud across Canada and the U.S.

Three forces driving this surge:

- AI-generated fake IDs that pass remote checks

- Remote online notarization (RON) and digital closings

- Absentee owners with properties that sit unmonitored

Criminals don’t need to hack land registries.

They just need to impersonate the owner convincingly.

The Deepfake Seller: A New Threat to Ownership Security

What’s happening right now:

Fraudsters target properties where:

- The owner lives abroad

- It’s a rental unit

- The owner is elderly

- The property is vacant

- There is no mortgage (clean title)

Then they:

- Create a fake ID in the owner’s name

- List the property using a real agent

- Use deepfake video to “appear” on Zoom

- Sign all documents digitally

- Route sale proceeds to offshore or mule accounts

The home is sold legally — but fraudulently.

The real owner discovers the crime months later.

Case Study: “The Condo That Sold Itself”

A condo owner living overseas discovered her Toronto property had been sold without her permission.

What happened?

- Fraudsters created a convincing ID in her name

- They hired a real listing agent

- They staged the unit by renting it temporarily

- They ran a full showing schedule

- They joined video calls with a deepfake face

- They signed documents using digital notarization

- The buyer closed with a legitimate lender

- The title transferred through the land registry

It took 8 months and a title insurance claim to unwind.

The buyer was protected.

The owner was eventually protected.

But the title insurer absorbed enormous cost.

This is now happening in Toronto, Vancouver, Calgary, Edmonton, Miami, Houston, L.A., London, Sydney, and more.

Why Title Companies Are Struggling

1. Trust-Based Identity Checks Still Rule

Most title offices rely on scanned IDs and “meetings” via Zoom or FaceTime.

Deepfakes pass both.

2. Remote Online Notarization Is Easy to Abuse

Remote Online Notarization makes closing convenient — but it also allows criminals to remain fully digital.

3. Lack of Cross-Stakeholder Communication

- Agents don’t tell lenders their seller behaves suspiciously.

- Title firms don’t always confirm identity independently.

- Lawyers assume agents vetted the client.

- No one owns the identity layer.

4. Fast Closings Reward Fraudsters

The quicker the deal, the less scrutiny.

The Insurance Fallout: A System Under Strain

Title insurers now pay out more fraud claims than ever before.

Industry-wide numbers show:

- Seller impersonation attempts have surged

- Fraud/forgery-related losses are 5× costlier than normal claims

- The majority of fraudulent deals involve remote or absentee owners

- Insurers are spending years unwinding fraudulent transfers

When a fraudulent sale goes through:

- The buyer expects protection

- The lender expects protection

- The rightful owner demands restoration

- Law enforcement is often slow or overwhelmed

So the insurer becomes the financial backstop for the entire ecosystem.

How Title Fraud Really Works

- Targeting

Vacant, mortgage-free, or absentee-owned homes. - Identity Creation

AI-built IDs, passports, licenses. - Engagement

Fraudster poses as the owner and hires an agent. - Transaction Execution

Showings, documents, and notarization happen normally. - Money Movement

Net proceeds wired to a mule account. - Discovery

Real owner learns about the sale months later. - Title Insurance Steps In

Large loss. Long legal battle. Multi-stakeholder cleanup.

Why Remote Sellers Are Most at Risk

Real owners who:

- are overseas

- are elderly

- have multiple properties

- travel frequently

- have long-term tenants

- inherited properties

- receive tax bills via digital mail

…often don’t discover fraud until it’s too late.

Fraudsters know this.

They choose owners who won’t notice for 90–120 days.

Red Flags for Seller Impersonation

These are the warnings agents, lawyers, lenders, and insurers should look for:

- Seller refuses video with clear lighting

- Seller avoids in-person notarization

- Seller pushes “urgent” closing timelines

- ID is scanned, not photographed

- Inconsistencies in property knowledge (“What direction does your balcony face?”)

- Email communication only — no phone calls

- The seller’s number is not connected to a geographic location matching the property

- Seller claims to be “out of the country” for vague reasons

- Signatures and ID photos appear “too perfect”

How Insurers Are Fighting Back

1. Seller Video Verification

Live calls where the seller must:

- move their head

- tilt the ID

- show environmental details

Deepfakes struggle with real-time motion and lighting.

2. Independent ID Validation

Cross-checking ID numbers with official databases.

3. Enhanced Notary Protocols

In-person notarization for high-risk transactions.

4. Property Alert Registries

Many Canadian jurisdictions allow owners to receive alerts for any land registry activity.

5. Closing Portals

Secure communication hubs replacing email.

6. Fraud Detection Units

Insurers building specialized teams that analyze:

- metadata

- document inconsistencies

- IP geography

- behavioural anomalies

- deepfake artifacts

Mini Example (BC, Canada)

A title officer asked a “seller” to hold their ID up to the camera and rotate it slightly.

The deepfake software couldn’t handle the motion.

The seller dropped off the call and never returned.

That 5-second verification prevented a six-figure fraudulent sale.

PART 4 — AGENTS, INTERMEDIARIES & CONSUMERS: WHERE HUMAN TRUST IS BEING EXPLOITED

Why Agents and Intermediaries Are the #1 Entry Point for AI-Driven Real Estate Fraud

Agents, brokers, lawyers, and escrow officers are prime targets because they sit at the most vulnerable intersection: high-value transactions + constant email communication + client trust. Fraudsters compromise or impersonate these professionals to redirect wires, authorize transfers, or impersonate sellers — often without anyone noticing until the money is gone.

The Real Estate BEC Problem: Fraud’s “Golden Entry Point”

Business Email Compromise (BEC) is now the most financially destructive real estate scam across Canada and the U.S.

Why?

Because everyone in real estate uses email to:

- send wiring instructions

- share agreements

- communicate closing timelines

- coordinate lawyers and lenders

- send ID documents

- update financial info

- confirm possession dates

A single compromised inbox gives criminals the entire playbook.

How scammers exploit it:

- Hack or spoof an agent’s or lawyer’s email

- Monitor communications quietly

- Wait until the closing day approaches

- Inject “updated wire instructions”

- Redirect $100K–$1M into a mule account

- Launder funds into crypto within hours

This is why wire fraud is so emotionally devastating: it happens at the exact moment buyers are most vulnerable — right before closing.

Example: A Family Loses Their $200,000 Down Payment

(A real case pattern, anonymized and simplified)

- Their agent’s email was breached

- Fraudsters inserted a perfect-looking email thread

- New “updated” wire instructions were sent at 4:55pm

- Buyers wired their entire savings

- The account was emptied within 3 hours

- Money was unrecoverable

The agent was devastated.

The buyers never closed on the home.

Everyone blamed themselves.

This scenario repeats time and again across North America.

Impersonation of Professionals: The New AI Twist

Fraudsters now impersonate:

- real estate agents

- mortgage brokers

- lawyers

- notaries

- title officers

- property managers

…using AI voice clones, fake listings, or deepfake video calls.

Example Pattern: The Fake Listing Agent Scam

- Scammer copies a real agent’s public profile

- Posts a rental or sale listing

- Collects deposits from multiple victims

- Disappears

Example Pattern: The Fake Lawyer Scam

- Criminal creates a spoofed domain that looks real

- Emails buyers or sellers with “legal instructions”

- Requests banking or wire info

- Vanishes with the funds

Example Pattern: Deepfake Title Officer on Zoom

Real Florida case pattern (simplified):

- Fraudster used an AI deepfake video of a “title agent”

- Attempted to verify identity and authorize instructions

- A title office employee noticed the eyes weren’t tracking naturally

- Fraud was stopped

- $250,000 loss avoided

This is now the new normal.

Why Real Estate Professionals Are So Exposed

Here are the top systemic weaknesses:

1. Email Is the Weakest Link

Most agents use:

- Gmail

- Outlook

- Free personal email accounts

Few use advanced protections like:

- SPF

- DKIM

- DMARC

- Secure portals

A fraudster would rather hack a realtor’s email than hack a bank.

And often — it works.

2. High Urgency + High Trust = Fraud Heaven

Real estate is emotional. Buyers and sellers are stressed.

Fraudsters weaponize urgency with messages like:

- “Send the wire now, or we delay closing.”

- “This is the last step — please act quickly.”

- “Funds must arrive by 5 pm today.”

Urgency suppresses skepticism.

Fraudsters know it.

3. Intermediaries Don’t Share Red Flags

An agent may notice something strange.

A lawyer may notice a mismatch.

A lender may see an odd bank statement.

But no one shares these signals, so fraud passes through gaps.

4. Professionals Don’t Receive Cyber Training

In Canada and the U.S., most professionals:

- Don’t know how spoofing works

- Don’t know how mule accounts operate

- Can’t identify deepfake artifacts

- Don’t follow secure wire protocols

And that’s not their fault — the industry has never trained them.

5. Public Information Makes Impersonation Easy

MLS listings + LinkedIn + brokerage websites reveal:

- agent names

- email formats

- phone numbers

- license numbers

- office roles

- transaction timelines

Criminals use this data to impersonate professionals convincingly.

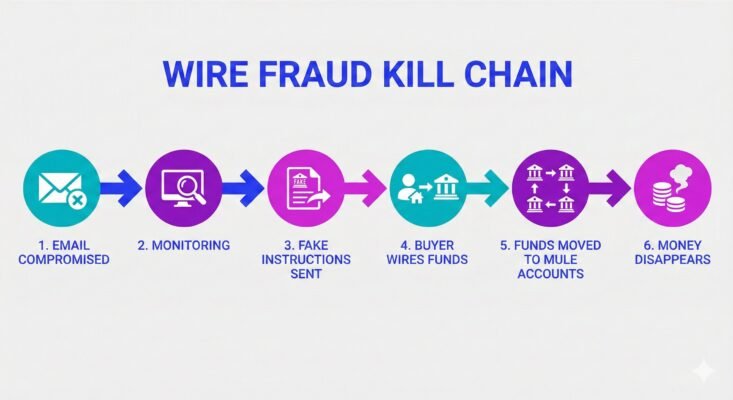

The Real Estate Wire Fraud Kill Chain

Here is the simple step-by-step process that fraudsters execute estate wire fraud:

- Email access

Fraudster hacks or spoofs an agent’s or lawyer’s email. - Silent monitoring

They watch threads for weeks. - Target identified

Buyer about to wire funds. - Fake instructions inserted

A perfect replica email is sent. - Wire sent

Funds go into a domestic mule account. - Rapid laundering

Funds moved into crypto or overseas. - Discovery

Often days later — too late for banks to claw back. - Devastation

Buyer loses savings. Deal collapses. Legal disputes begin.

Consumer-Facing Scams: The End-User Kill Chain

Real estate fraud doesn’t only hit professionals — it hits consumers hardest.

Here are the most common scams:

- Fake listings (rentals & sales)

- Fake agents

- Fake “landlords abroad” scams

- Escrow redirection

- Title theft

- Deepfake government calls (“issue with your title”)

- Fake property management scams

Most victims only realize after the money is gone.

The Emotional + Financial Damage (High-Level)

These crimes destroy more than bank accounts.

Victims describe:

- anxiety

- depression

- shame

- marital strain

- loss of homeownership dreams

- distrust in the entire system

- years of recovery

One victim in Vancouver called it:

“the worst experience of my life — worse than losing my job.”

Real estate fraud isn’t just financial. It’s psychological.

Red Flags for Agents, Lawyers & Consumers

- ✔ ID looks too crisp

- ✔ Seller avoids video calls

- ✔ Email tone “feels different”

- ✔ Urgent changes in instructions

- ✔ Last-minute account name mismatch

- ✔ Bank account is newly opened

- ✔ Client refuses in-person notarization

- ✔ Buyer/seller insists on a rapid close

- ✔ Communication moves to WhatsApp/Signal

- ✔ Numbers don’t match local area codes

Most frauds show at least one of these signals.

Many show three or more.

10 Simple Transaction Protections Everyone Should Use

(The “BranchedFlow Real Estate Cyber-Safe Checklist” — high-level edition)

- Always verify wire instructions by phone using a known number

- Use secure portals, not email, for financial information

- Require live video ID verification for sellers and borrowers

- Set up land registry alerts for property title changes

- Use two-factor authentication on all email accounts

- Confirm any party’s identity via two separate channels

- Check IDs under real light, not just scans

- Never accept last-minute wire changes

- Pause the transaction if anything feels off

- Document all verification steps to establish duty of care

These are simple, practical, and powerful — the majority of fraud losses are preventable with these steps alone.

Is Your Brokerage “Transaction Safe”?

Measure your defence against wire fraud, deepfakes, and liability in under 3 minutes.

- Liability Check: Assess if your email protocols meet new “Duty of Care” standards.

- Process Audit: Spot human vulnerabilities in your closing workflow.

- Compliance Alignment: Ensure readiness for new BCFSA & FINTRAC mandates.

- Competitive Edge: Turn transaction safety into a trust-building asset.

Stop guessing. Get a benchmarked score and a personalized roadmap to protect your practice.

Frequently Asked Questions

Title insurance protects against financial losses from forgery or ownership fraud, but it doesn’t prevent the fraud itself. Owners should still use land registry alerts, secure communication channels, and proper ID verification. Title insurance helps recover losses, but proactive monitoring helps stop fraud before it spreads.

In Canada, agents increasingly carry an expectation of “duty of care” regarding digital security. While not explicitly required in all statutes, regulators expect reasonable precautions, including verifying IDs, educating clients about wire fraud, and using secure communication tools. Neglect can expose professionals to liability and E&O claims.

Once funds hit a mule account, criminals quickly break them into smaller transfers or convert them to cryptocurrency. Banks often have only a small time window to attempt recovery. Delayed discovery or weekend transfers reduce the chance of freezing funds through Rapid Response Programs.

Investors should assess whether parties use secure portals, verify all identities through live video, confirm title office legitimacy, and cross-check wire details by phone. They should also review whether the agent or brokerage uses MFA and anti-spoofing controls. Transactions involving absentee sellers require extra scrutiny.

Yes. Canada has seen rising cases of seller impersonation, fraudulent condo sales, and mortgage fraud supported by AI-generated documents. Provinces like Ontario, B.C., and Alberta report significant increases. The combination of digitized land records and remote closings makes Canada a growing hotspot for deepfake-enabled real estate crime.

External Sources & Regulatory References

Accessed: 2025

- FBI IC3 Annual Report (2024) — official U.S. cybercrime, BEC, and real estate fraud statistics.

- FBI — Real Estate Scam Alerts — trends, warnings, and case reports.

- FBI — Business Email Compromise Resource Page — foundational guidance on wire-fraud and email compromise.

- U.S. Department of Justice — mortgage fraud, wire fraud, and identity crime prosecutions.

- U.S. Secret Service — Financial Fraud Programs — BEC, wire fraud, and money mule disruption.

- FinCEN — Mortgage & Real Estate Fraud Advisories — U.S. Treasury guidance on synthetic identity, deepfakes, and illicit finance.

- Federal Reserve System — research on synthetic identity fraud and digital payments risk.

- FFIEC — Authentication & Identity Verification Guidelines — U.S. interagency standards for onboarding and fraud controls.

- FINTRAC — Identity Verification Guidelines (Canada) — AML, KYC, and real estate transaction ID standards.

- OSFI — Financial Institution Guidance (Canada) — expectations for lenders, insurers, and fraud risk controls.

- INTERPOL — Global Cyber & BEC Operations — multi-country disruption initiatives related to real estate fraud.

- NIST — Digital Identity Guidelines — official standards for biometrics, deepfake resistance, and identity proofing.

- Government of Ontario — Land Registry Access — title activity monitoring and fraud alert systems.

- Ontario Land Registry Services — title fraud prevention and legal processes.

- British Columbia Land Title & Survey Authority (LTSA) — title verification and ownership security resources.

- Alberta Land Titles Office — provincial registry information and property protections.

- HM Land Registry (UK) — alerts, compensation, and international case patterns.

- ALTA — American Land Title Association — U.S. title fraud, seller impersonation, and escrow security insights.

- Canadian Real Estate Association (CREA) — consumer protection and fraud-awareness bulletins.

- National Association of Realtors (NAR) — wire fraud guidance and cybersecurity resources.

- Propertymark UK — agent due diligence and seller-verification best practices.

- First Canadian Title (FCT) — identity risk insights and title fraud case analysis.

- National Insurance Crime Bureau (NICB) — insurance-linked identity fraud and synthetic claim trends.

- Global News (Canada) — reporting on title theft and home impersonation cases.

- CBC / CityNews — Canadian investigations into seller impersonation and false listings.

- Local10 News (Florida) — deepfake seller case prevented by a title officer.

- HousingWire — title fraud statistics, insurer losses, and market risk trends.

About the Author

Dr. Joseph Mwangoka is the Founder & Lead Consultant at BranchedFlow Inc., specializing in cyber-fraud prevention, financial crime strategy, and digital trust architecture. Dr. Mwangoka helps organizations convert cyber-fraud exposure into strategic advantage.

Disclaimer: This article is for educational purposes only and does not constitute legal, financial, or cybersecurity advice.